Is it really time to panic?

-Words by David Stealey, Managing Director and Chartered Financial Planner of 32 years for Romilly Financial

If like me you have been around the block a few times, economically speaking, you will remember quite a few occasions in the past where panic has set in over our economy. What I can’t recall over the years is the kind of political chaos that we are struggling with now. No matter which political party you support, we all still have to live with an elected government, whose work is supposed to keep out world ticking over, food on our tables, and warmth in our bones.

Despite us living in a world where social media confrontation and bickering seem to prevail, one thing does unite us whether we like it or not, we are all in this together. Over the coming months, as the economic fallout from high inflation and high interest rates bite, we will all have to hunker down, do our best, and hold on tight.

For both investment and borrowing clients alike these uncertain times elicit panic. I am particularly sensitive to those who are experiencing this for the first time. New borrowers. Young people who are seeing their mortgage rates rise for the first time do not know what it is like to pay interest at 14%. They are questioning costs when rates are at just 5%. However, if spending eases, inflation will lower, and energy costs should eventually ease. That will allow our MPC and government, whichever political party, to reduce interest rates back down to what should be considered the accepted norm. We must remember that base rates at 0.5% are not the accepted norm, it has been our safe place only for the last 10 years.

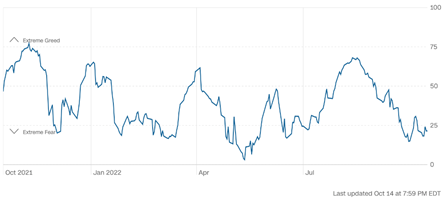

We recently sent a communication from Brewin Dolphin, the discretionary fund manager with whom we have a good relationship. They make use of the CNN business Fear and Greed Index, which is used as a barometer of market sentiment. As it stands at the moment, we are struggling and have Extreme Fear, although, as they note, this fear seems to have been going on for quite some time. What they didn’t point out was that in the summer, the fear started to abate and that we were beginning to get back to what was considered normal market conditions. Pressure from inflation remaining stubbornly high and the current political chaos is once again severely disrupting these markets on a global scale.

This current rating reflects the market turbulence that we have been over the last month or so. It feel like we have stuck in this Fear rating forever! Not really. In fact, markets regained some of their poise during the summer, as you can see below.

So back to my questions, do we really need to panic? If there is one thing that I have learned over time, do not make rash decisions. Cashing out, fixing in, or taking any action before considered thought often leads to regretful hindsight. What I know at this time is that somewhere behind the clouds, the sun will still rise, governments will still cause chaos, and the good times will come back again. Everything in life moves in cycles, so do not panic, take a moment to think, and take action that most suits you.

For more information, you can find Romilly Financial at 26 Hickman Road, Penarth. Give them a call on 029 2041 5100 or drop them an email at info@romillyifa.com. And you can always visit their website here.